The State of Circular Innovations in the Indian Fashion and Textile Industries

Retail and Use

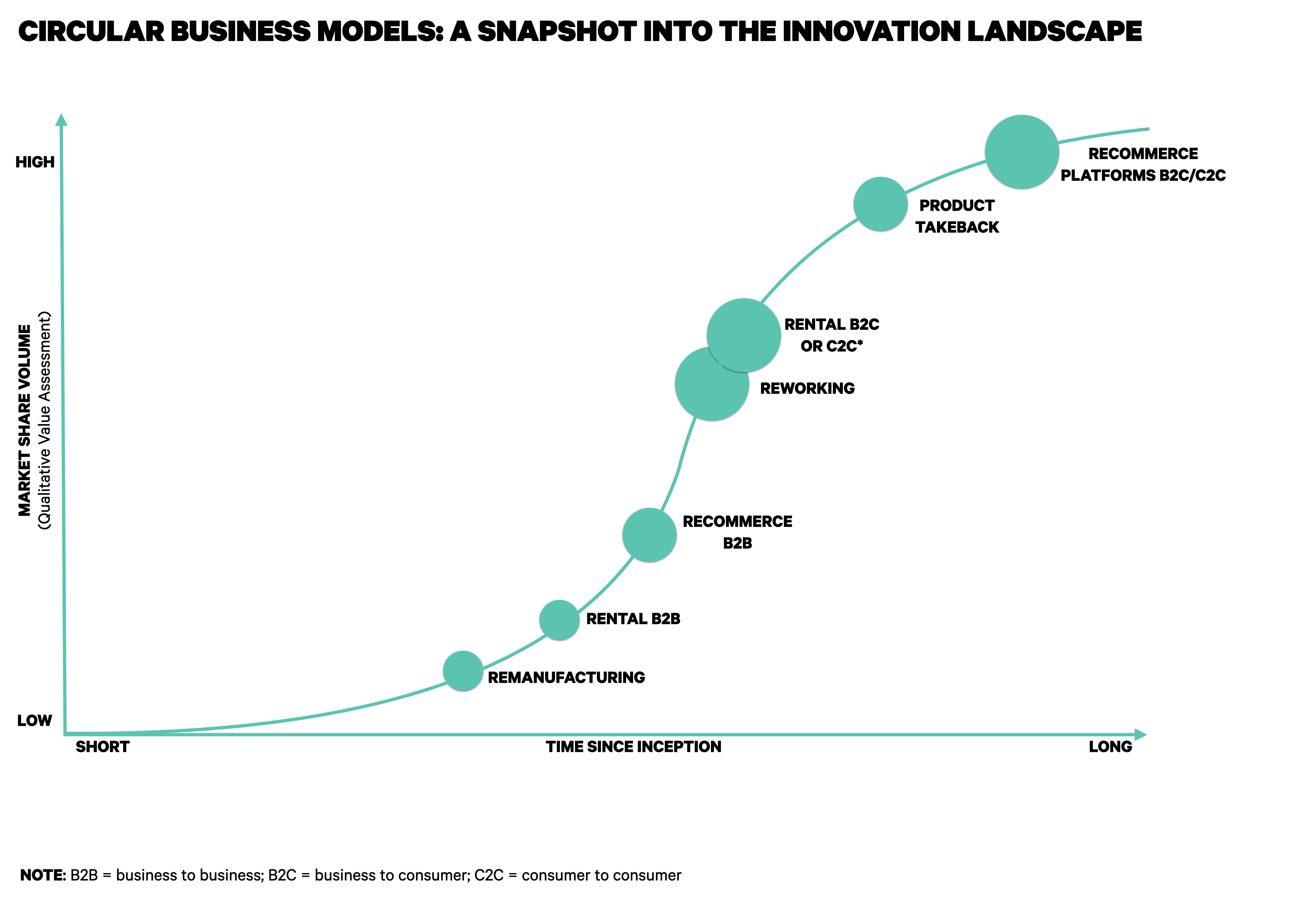

While often not at the forefront, the retail and use stage poses challenges that multiply the environmental footprint of the fashion industry. It is estimated that doubling the lifetime of a garment reduces its environmental impact by 49%32, by saving carbon emissions and water that would be used in the production of new garments. Circular business models aim to keep existing garments in use for a longer period while also changing consumer behaviour. Below details the various types of circular business models as well as where they are on the global maturity curve.

KEY FINDINGS FROM THE REGION

- Rental models have gained significant success in the luxury and occasion wear segment.

- India has a thriving ecosystem of re-workers who lengthen the life cycle of both pre- and post-consumer textile by converting them into new accessories and home decor.

- Virtual and Augmented Reality solutions with applications for ecommerce and brick-and-mortar retail are still a niche but growing sector.

FOCUS AREAS

CIRCULAR BUSINESS MODELS (CBM)

CBMs fall into three main categories: recommerce, rework and rental. Recommerce platforms include solutions where consumers can purchase used but good quality garments from either a curated platform, a brand or other consumers. The garments have previously been sorted, cleaned and sometimes restyled or renewed before resale.

Rework innovations create contemporary designs utilising the excess stock by customising, deconstructing and resewing garments. India has a traditional culture of repair and rework through the widespread network of hyper-local tailoring and repair businesses. This cultural inclination to sustainability shifted in the 90s with the advent of ready-to-wear brands, both domestic and international, entering the market33, leaving a fragmented repair and rework market. Innovators have responded with service-based enterprises aimed at formalising and organising the repair market. All of these innovations rely on a robust logistics network of at-home, pick-up and drop-off services, which help scale these models.

Rental platforms allow consumers to rent garments for one-off occasions or on a monthly basis, allowing consumers access to a wider range of products whilst also extending the life of the clothes. Rental is a burgeoning area of innovation in India and is expected to grow 22% by 202734. For many of these platforms, sourcing of garments utilises dead stock and the focus is primarily on occasion wear.

Beyond the environmental benefit of lengthening the life cycle of clothing, there are tangible business benefits of circular business models for the brands. Brands can improve their stock management, increase customer loyalty and revenue potential35. It also gives the industry an incentive to invest in high quality materials for long-term use. Consumers get an opportunity to access new styles without needing to buy new products. It also enables them to get value out of their own wardrobe by utilising peer-to-peer recommerce and rental platforms.

Flyrobe is India’s only VC-funded clothing rental platform, which was acquired by Myntra, a popular shopping platform. With a focus on occasion wear, the platform rented out clothing worth over $10 million in retail value in 2017. It offers pick-up and drop-off logistics and also has brick-and-mortar stores in seven cities around the country36.

Mumbai-based zero-dividend company ‘I was a Sari’ sources pre-worn saris from informal physical resale markets like Chor Bazaar in Mumbai and employs under-privileged craftswomen to rework them into luxury garments and accessories. I was a Sari received the Green Carpet Ethical Award and the Lakme Fashion Week Circular Design Challenge in 2019.

FIGURE 6

REGIONAL OPPORTUNITIES

- In Rental and Recommerce, segments other than luxury remain unexplored. Segments with limited time use such as maternity and children’s wear offer a significant opportunity.

- Recommerce and repair have long been an inherent part of everyday society, India has a thriving ecosystem of re-workers who lengthen the life cycle of both pre and post-consumer textile by converting them into new accessories and home decor. There is an opportunity for formalisation of these informal sectors leveraging digital innovation.

- A consolidated supply chain of dead stock and export surplus would streamline feedstock and enable scaling of circular business models such as rental, recommerce and rework.

There is a significant need for innovation and collaboration in the Retail Industry. In this COVID-19 pandemic situation, it’s imperative to collaborate with stakeholders for business sustenance and bring systematic change towards responsible stewardship. One of the key areas where innovations are unfolding is that of New Circular Retail Business Models pegged on rental, repair and resale which aim to extend the life cycle of garments. The other visible innovation trend is leveraging technology to drive greater efficiencies, design out waste and create superb customer experience in the retail space."

Naresh Tyagi, Chief Sustainability Officer, Aditya Birla Fashion and Retail Limited