Wealth in Waste: India’s Potential to Bring Textile Waste Back Into The Supply Chain

Executive Summary

INDIA’S UNTAPPED POTENTIAL FOR CIRCULARITY OF TEXTILE WASTE

India is one of the largest textile and apparel sourcing regions in the world due to abundant availability of raw materials and skilled workforce.

The Textile and Apparel industry is one of the largest contributors to India’s economy constituting 2% of total GDP, 12% of total exports, 7% of industry output in value terms12, while employing over 45 million individuals.3 4 India is also one of the largest producers of cotton, jute and silk. Over 25% of the global cotton production comes from India.5 Further, India has processing infrastructure and skilled workforce for all activities ranging from spinning to apparel production, making it a competitive key sourcing destination for most global brands.

The textile industry all over the world leads to substantial waste generation* during production and consumption of textiles and apparel. This waste can be classified across three waste streams: pre-consumer, domestic post consumer and imported waste.

Pre-consumer waste is generated during and post-manufacturing across Cut-Make-Trim (CMT) units, fabric mills and spinning; domestic post-consumer includes garments/ textiles discarded by domestic consumers. waste includes second-hand clothing and mutilated rags imported to India. India’s decadesold embedded culture and history of reusing, remaking and redesigning garments has enabled informal trade routes for textile waste and infrastructure to process it.

While India is one of the leaders in mechanical recycling in the world, it has not yet established a circular approach for textile waste.

The concept of circularity advocates for a regenerative system wherein textile is used as long as it retains its value and is recycled to its full potential within the textile industry, minimising leakage, waste and pollution.

To date, the value chain remains largely unorganised with limited visibility, leading to leakage of waste at multiple levels. There has been minimal external support for technological advancement and process standardisation.6 Consequently, the recycled yarn produced is of low quality and is deemed unfit for the global supply chain. This, coupled with the stiff competition from inexpensive synthetic fibres, is limiting the economic growth and viability of the recycling industry in India.

The growing need of circularity in the textile industry globally provides India with a unique opportunity to leverage existing infrastructure and resources to emerge as a leading circular sourcing region.

Over the years, despite the absence of technology, the Indian textile recycling ecosystem has established a strong hold in mechanical recycling by way of manual sorting, combining specific colours and fibres to reach desired quality. By doing so, they have been able to extract economic value even from nonrecyclable waste. However, this infrastructure and expertise has been handled by informal channels. Value chains can be formalised to establish circularity of textile waste in India if this infrastructure and technical know-how is supported by brands, governments and investors.

UNDERSTANDING INDIAN TEXTILE WASTE LANDSCAPE

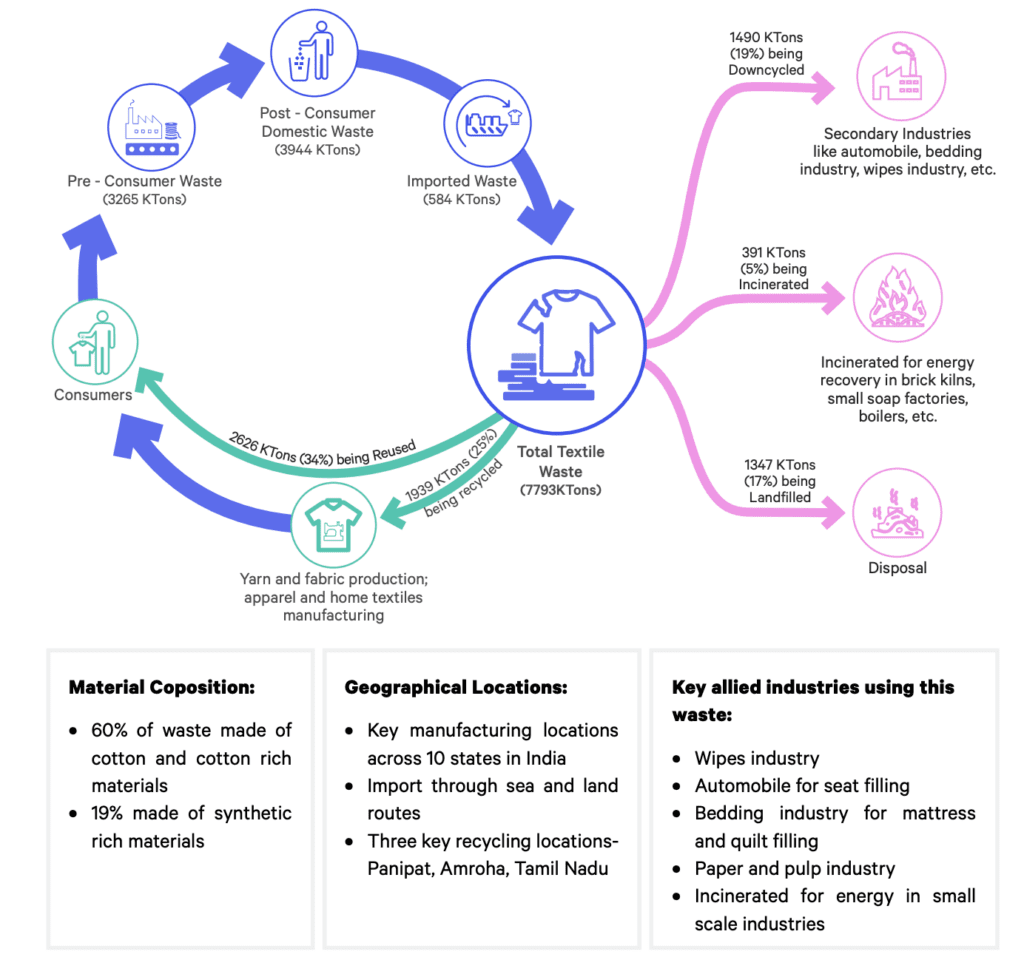

Approximately 7793 ktons, or 8.5% of global textile waste7 , is accumulated in India every year. 59% of this waste finds its way back into the textile industry through reuse and recycling but only a fraction of this makes it back into the global supply chain due to quality and visibility challenges. The remaining 41% is downcycled (19%), incinerated (5%) or ends up in a landfill (17%).

Furthermore, 34% of the total waste is reused directly or repaired and converted into new products, while 25% gets recycled into yarns. India is a global leader in mechanical recycling; however, a significant portion of the recycled yarns are made through a low-grade recycling process. These recycled materials end up in the domestic markets as opposed to the global textile supply chain. The study was unable to estimate the exact proportion of low-grade recycling due to multiple material compositions and market factors affecting the end use.

Illustration 1: Total quantity of textile waste in India, end-use and destination of textile waste

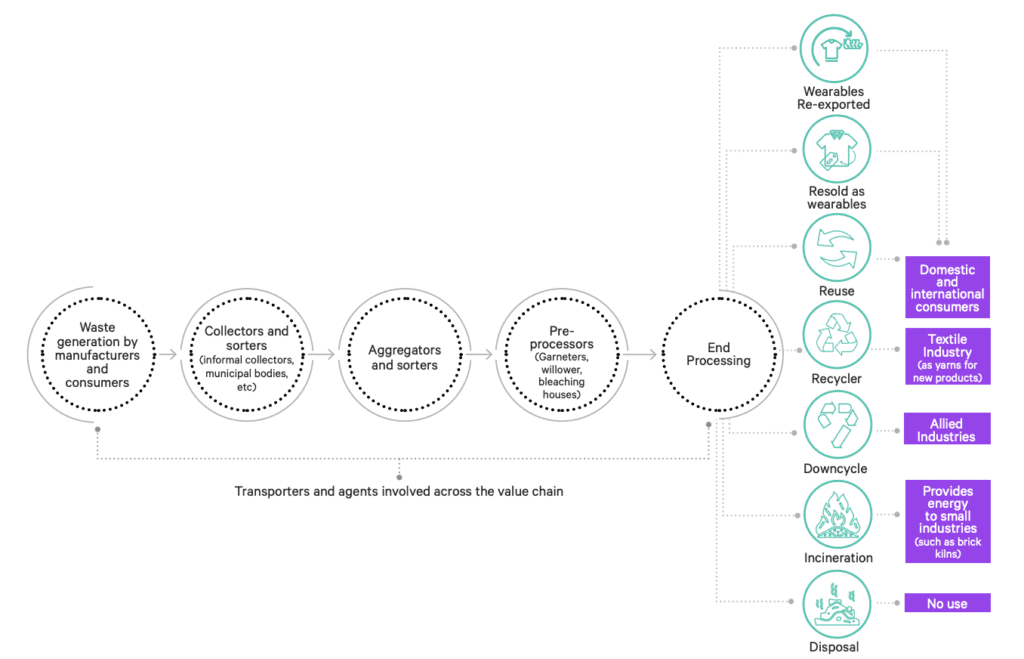

India has a well-networked textile waste value chain, though unorganised, enabling transfer of waste across the country. However, the lack of traceability systems, excessive cost competitiveness, limited infrastructure to process certain waste types, and worker wellbeing concerns has limited the potential of a circular value chain.

Illustration 2: Snapshot of textile waste value chains in India

PERCEIVED HIERARCHY OF WASTE BASED ON TYPES, SIZE, COLOUR, MATERIAL COMPOSITION AND CONDITION

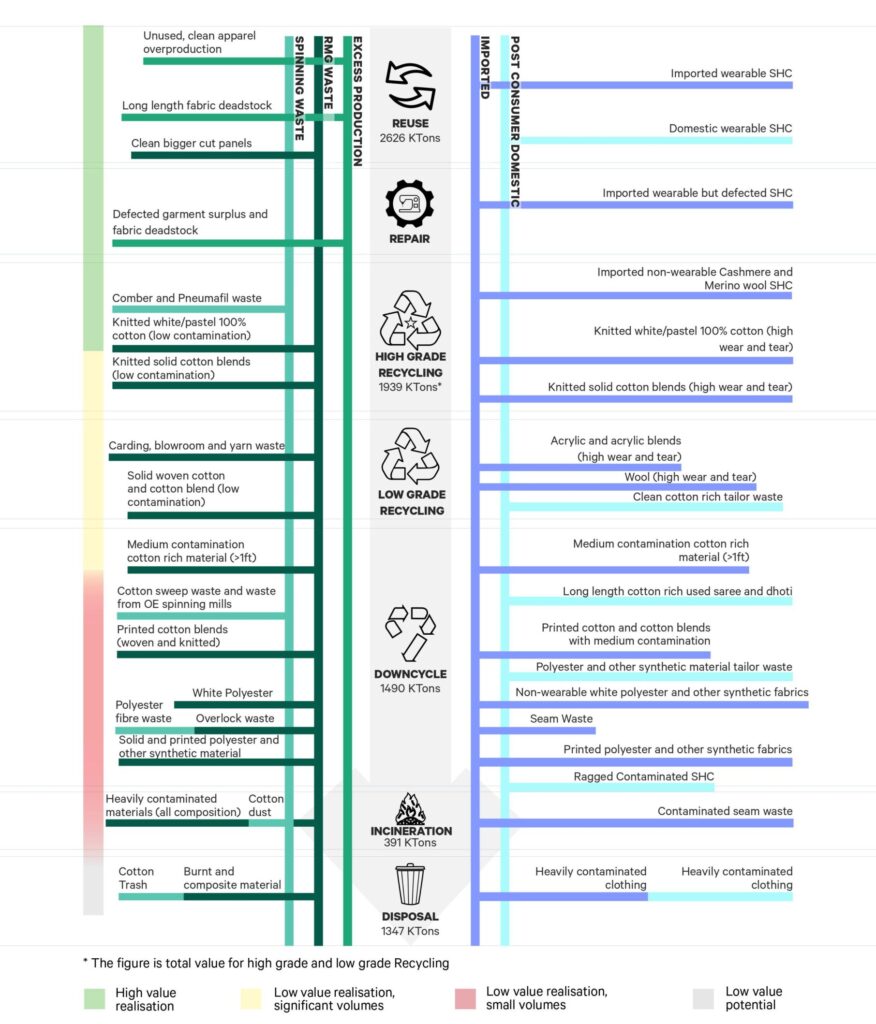

Using the EU waste hierarchy framework8 , this study has developed a first-of-its-kind textile waste value hierarchy for India that provides a consolidated view of how the ecosystem currently perceives the value of the different waste types

The waste value hierarchy framework was developed to understand the current use of various waste types and identify materials that can be valorised. This hierarchy, though not exhaustive, acts as a toolkit to understand material types that require interventions to realise their value potential. Beyond positioning the waste types within each textile waste stream, the industry also compares waste types within the three waste streams as demonstrated in illustration 3.

100% white cotton waste has the highest value in the industry. Additional attention should be placed on printed and synthetic materials as the current infrastructure and technologies are limited in their capabilities to process them.

Less than 50% of the textile waste in India is currently being reused, repaired or undergoing high grade recycling. These materials include fabric deadstock, re-wearable clothing, apparel overproduction and white-knitted 100% cotton waste. On the other hand, solid coloured cotton, MMCF blends and printed textiles form a significant volume of total waste generated in India but are not being utilised to the fullest potential as the current recycling technologies are limited in their capabilities to process them. Low volume waste including certain spinning waste types and printed materials have very little value being retrieved currently but hold a high value potential. Further, heavily contaminated and ragged materials which have reached the end of their life are difficult to retrieve and they end up being incinerated/ landfilled. From a circularity perspective, one can work to reduce generation of waste at consumers’ end and manufacturers’ end to reduce waste going to landfills/ incineration and identify use cases to retrieve them back into textile value chains to achieve full potential of all textile waste types.

Illustration 3: Hierarchy of different textile waste types across waste streams in India9

MOVING WASTE UP THE HIERARCHY AND VALORISING WASTE TO FULL POTENTIAL

Traceable and higher quality feedstock is required to meet the demands of advanced recycling technologies being adopted across the industry.

The global textile industry is moving towards decarbonisation and there is momentum in the industry to reach net-zero within the next three decades. To achieve this, the industry must reduce the use of virgin materials, avoid waste leakage, and circulate waste through reuse and recycling.

To enable this circular approach, high-grade mechanical and chemical recycling technologies that recycle cotton and polyester blends must be implemented. As these innovations develop large scale capacity, they require large volumes and high quality textile waste as feedstock. However, achieving high quality feedstock requires visibility across the supply chain, as well as traceability of materials and their composition. India’s large volumes of cotton, cotton rich (~4700 ktons) and polyester waste (~1400 ktons) can be fed into the recycling innovations to meet demand.

However, achieving high quality feedstock will require visibility across the supply chain, as well as traceability of materials and their composition. The exponential growth of recycling technology requires uncontaminated waste and a system to acquire traceable waste. High quality feedstock and supply chain traceability enable waste to move up the hierarchy and scale higher value realisation.

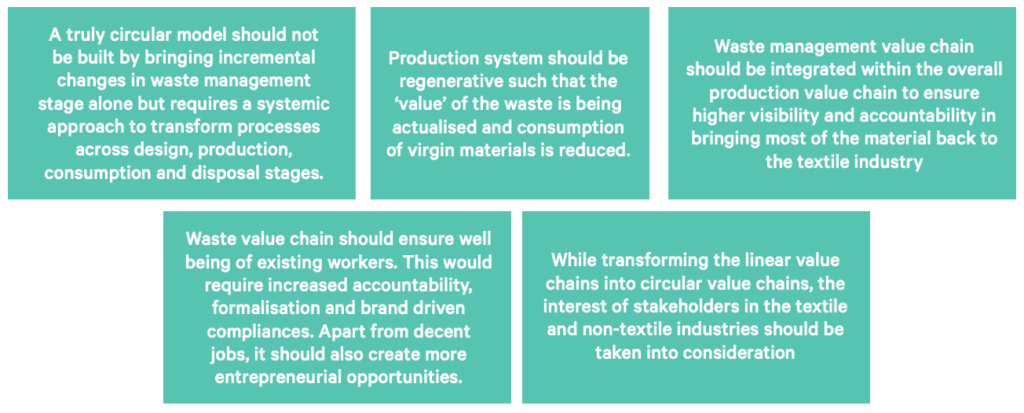

To transition from linear to circular economy, the industry needs to transform all stages of production to reduce waste generation and consumption of virgin materials, while valorising waste to its fullest potential. Further, this transition should account for the well-being of all stakeholders across the value chain and their interests.

Illustration 4: Key principles for circularity of textile waste in fashion industry

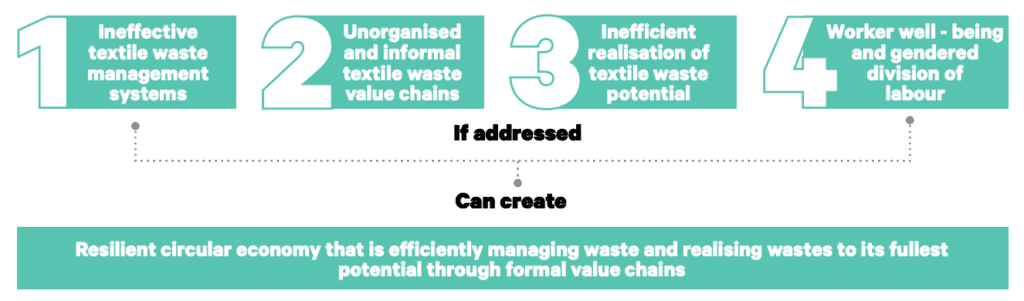

To realise the full potential of textile waste in India and achieve circularity, various bottlenecks need to be overcome. The study identifies four bottlenecks that the industry faces and calls for collaborative, systemic interventions to build circularity in the textile industry.

Illustration 5: Key bottlenecks in Indian textile waste industry

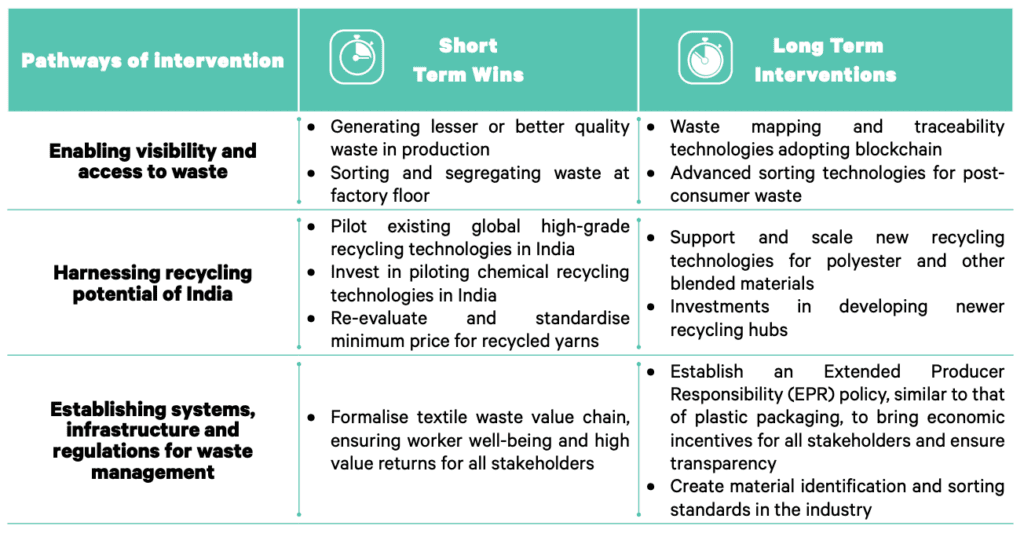

This report identifies the pathways of intervention that have been categorised in the following short term and long term reforms.

Illustration 6: Suggested recommendations to enable circularity of textile waste in short and long-term

The textile waste value hierarchy presented in this report is a starting point for the industry to look at the various types of waste available and reassess their utility to enhance value realisation. The recommendations are a call-to-action to build a resilient circular economy that efficiently manages waste to its full potential.