Unlocking the Trillion-Dollar Fashion Decarbonisation Opportunity

Executive Summary

The carbon footprint of the fashion industry is globally significant, evidenced by a growing number of studies, most recently World Resources Institute (WRI) and Aii (2021). The report estimates that the industry’s share comprises 2% (1.025 gigatons CO2eq) of annual global greenhouse gas (GHG) emissions, with most impact taking place in the raw material and processing steps of the supply chain.

Over the last decade, the transformation to a sustainable industry has become of higher priority. What has been an attractive way of working for decades is now increasingly pressured by regulation, media attention, consumer awareness, exposure to supply chain risks, scarcity of commodity materials, and shareholders’ ESG demands.

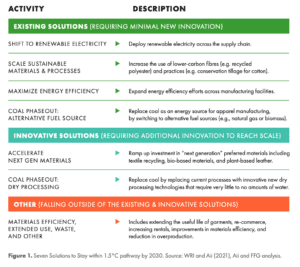

This growing problem and the inevitability of a radical transformation over the next decades has spawned a wide variety of actionable opportunities across the industry’s $2 trillion supply chain. The recently published WRI and Aii (2021) report identifies six solutions the fashion industry can adopt to deliver the GHG reductions needed to stay within the 1.5°C pathway by 2030. Additionally, for the purpose of this analysis, this report makes two changes to the interventions proposed by WRI and Aii (2021):

i) Split ‘Phase Out Coal’ into two parts – one through switching to alternative fuel sources and the other through transitioning to dry processing technologies

ii) Combine materials efficiency with extending useful life and reduction in overproduction.

These are reflected in Figure 1 below:

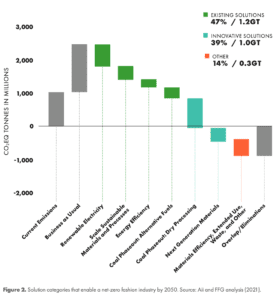

The solution categories in scope of this report enable a net-zero industry to be achieved by 2050. With a combined GHG emissions reduction potential of 2.5 Gt CO2eq, of which 1.2 Gt (47% of combined solution categories) will be contributed by solutions already existing today, 1.0 Gt (39%) by innovative solutions, and 0.3 Gt (14%) by other solutions including materials efficiency and reducing overproduction.

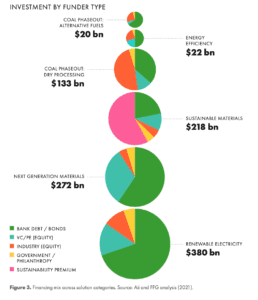

The total investment required to fund the entire range of solutions shown above amounts to just over $1 trillion — according to analysis by Aii and Fashion for Good. 61% of the financing is required to implement the existing solutions, with the remaining 39% of funding required to further develop, scale and implement the key innovative solutions. However, given that each decarbonisation solution has a unique risk-return, the funder type differs across the board.

Given these large investment amounts, current levels of commitment and financing are insufficient to succeed in adequately decarbonising the industry before 2050. It is unlikely that the industry will achieve the necessary transformation without a significant change in financing flows to accelerate the adoption of a wide range of efficiency and emissions reduction solutions.

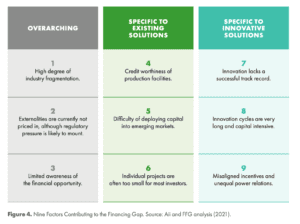

Based on interviews with manufacturers, investors, and key industry stakeholders, nine key factors that contribute to a lack of financing availability have been identified (see Figure 4).

To reach net-zero, Scope 3 solutions are imperative. Net-zero can be achieved, however it requires an aggressive acceleration in the implementation of currently existing solutions and a substantially higher focus on driving innovative solutions, together triggering a $1 trillion financing opportunity across financing types.

THE KEY RECOMMENDATIONS PER STAKEHOLDER ARE AS FOLLOWS:

GOVERNMENT/PHILANTHROPIC:

Government—Strengthening Policy Framework and Mechanisms to Catalyse Private Investment

Although regulatory action has begun to influence the industry’s move toward sustainability, more regulatory pressure is needed to support the business rationales and provide incentives that will drive systemic change. Specifically, the public sector should:

- Offer government-backed loan guarantee funds and/or green banks to de-risk loans to facilities (i.e., green bank takes first loss on loans to facilities)

- Align upcoming regulatory taxonomy with existing methods used to measure, report and reduce GHG emission (i.e., Corporate Sustainability Reporting Directive)

- Link regulations to preferential trade agreements with key importing countries

- Provide additional economic incentives for low-carbon production and energy use, such as tax credits, eco-modulated fees, and feed-in tariffs

Philanthropy—Encourage Coordination, Promote Early-Stage Catalytic Work, and Explore Blended Capital Approaches

Philanthropy has a critical role to play in de-risking projects in order to unlock other forms of capital, specifically:

- Funders play an important role in partnering with financial capital to make edge-case projects viable.

- Fund early-stage catalytic work in order to de-risk solutions prior to industry and traditional financial capital taking them to scale

- Fund and encourage coordination between existing industry organisations

STRATEGIC / INDUSTRY:

Manufacturers—Adopt a Strategic Capital Improvement Plan that is Aligned with Brand Partners

Many of the investments that are needed to reach net-zero have positive financial and strategic benefits to manufacturers. These benefits are stronger for manufacturers that:

- Proactively adopt a strategic plan for funding sustainability initiatives and adopting new innovations

- Discuss and align environmental priorities with key brand partners

- Join programmes that aggregate multiple manufacturers for better financing options

- Evaluate projects based on both GHG reduction potential, as well as financial ROI

Brands—Stronger Engagement and Commitment to Innovation and Suppliers

Brands sit at the nexus of all stakeholders and therefore have a critical role to play in accelerating investment in the sector. Some steps that brands can take include:

- Offer more support to their suppliers through volume guarantees, pilot projects, and direct investments

- Create cross-functional working groups with finance, sourcing, and sustainability teams to identify innovative financing opportunities

- Brands can serve as an important intermediary for moving capital from investors to manufacturers

- Collaboratively adopt an aligned roadmap to create a clear understanding of collective brand demand

- Source materials based on GHG emissions, not just price and performance

FINANCIAL CAPITAL:

Banks and Lenders—Prioritise Key Production Regions and Innovative Financing Opportunities

As the largest source of funding, banks and lending institutions can accelerate their impact if they:

- Prioritise key production regions, which are attractive for investment yet underserved by international financiers

- Support innovative transitional financing opportunities (e.g, coal phase out programme), which are large in size and low in risk

- Fund local banks directly in local currency loans in order to reach small and medium sized enterprises

Equity Investors – Become Familiar With The Increasingly Large Array of Investment Opportunities

In order to achieve GHG emission targets, equity investors must:

- Advance their industry expertise and join forces with brands, supply chain partners and innovators to develop investment propositions that match their risk-return profiles.

- Evaluate projects based on both GHG reduction potential, as well as financial ROI.

To mobilise $1 trillion through overcoming the aforementioned barriers, a concerted and collaborative effort is needed by key stakeholder groups inside and outside of the industry: financiers (debt and equity), manufacturers, brands, philanthropy and governments. The recommendations to stakeholders are centered around the conditions required to enable a larger flow of financing towards these projects — it is critical to create an environment where investors are presented with projects that are (1) attractive from a risk-return perspective (2) impactful and (3) understandable. Net-zero can be achieved, however it requires an aggressive acceleration in the implementation of currently existing solutions and a substantially higher focus on driving innovative solutions, together triggering a $1 trillion financing opportunity across financing types.