Unlocking the Trillion-Dollar Fashion Decarbonisation Opportunity

The Urgency to Decarbonise the Fashion Industry

The Urgency to Decarbonise the Fashion Industry

THE FASHION INDUSTRY’S GREENHOUSE GAS CHALLENGE

The global fashion industry is a multi-trillion dollar industry, producing over 100 billion garments annually. Given its size and nature, the industry faces a number of social and environmental challenges. The key environmental challenges are complex and interrelated, but most broadly fall under: land use, water use, chemical use, biodiversity loss and greenhouse gas (GHG) emissions. This paper focuses on the latter — GHG emissions.

With the global average temperature projected to rise by, or even exceed, 3°C this century — well beyond the 1.5°C goal of the Paris Agreement, drastically curbing industry GHG emissions is an unequivocal and necessary action that must be taken in order to limit global warming.

The recent Intergovernmental Panel on Climate Change (IPCC) 2021 report found that unless there is a rapid and large-scale reduction in GHG emissions, unprecedented in both speed of implementation and scale, limiting warming to 1.5°C will be beyond reach.4 Beyond the 1.5°C limit, the prevalence of extreme weather patterns will drastically increase and the effects will be catastrophic and irreversible.

Recent publications have estimated the GHG emissions associated with the fashion industry — with figures ranging from between 2% – 8% of annual global emissions.5/6/7 Whilst methodology differences lead to wide ranging estimates — one thing is for certain: the fashion industry supply chain is a significant contributor to global GHG emissions. The Net-Zero Challenge: The supply chain opportunity report by World Economic Forum (WEF) and Boston Consulting Group (BCG) (2021) placed fashion as third in the ‘Big Eight’ industry-emitting supply chains, behind food and construction, with similar emissions to Fast Moving Consumer Goods (FMCG).8

The GHG emissions of the fashion industry are globally significant and evidence has shown that change is required at an unprecedented rate and scale; however, the decarbonisation opportunities in the fashion industry are wide-ranging and diverse. Recent analysis from The World Resources Institute (WRI) and Apparel Impact Institute (Aii) (2021) has mapped solutions to decarbonise the industry and guide the industry to align with a 1.5°C pathway by 2030. Leveraging the industry expertise of Aii and Fashion for Good, coupled with the vast financing knowledge of HSBC, this report builds off previous analysis to map the solutions required to a net-zero pathway by 2050 and estimates the financing required to get the industry there.9

Understanding the financing opportunities and sources for implementing the decarbonisation solutions is absolutely pivotal to map a pathway for the future. Financing opportunities are divided by type of financier — illustrating the need for engagement for stakeholders across the finance industry. Sector-specific financing barriers are outlined, before presenting calls to action across each stakeholder within the industry to help to overcome these challenges and help the fashion industry achieve a net-zero future.

GHG Emissions in the Fashion Industry

UNDERSTANDING THE SCOPES AND TIERS

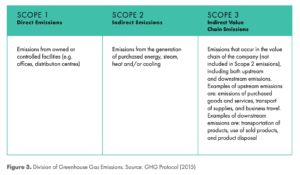

As with other industries, GHG emissions in the fashion industry are divided and measured — in keeping with the Greenhouse Gas Protocol’s Corporate Accounting and Reporting Standard, across three Scopes; direct emissions, indirect emissions and indirect value chain emissions respectively.10

Given Scope 1 and 2 — direct and indirect emissions, are under direct control of an organisation, they are easier to measure and report. However, the complex and fragmented nature of fashion supply chains means that Scope 3 — Indirect Value Chain emissions, which represent the vast majority of emissions, have, up until recently, been somewhat overlooked and are typically the least reported.11

Scope 1 and 2 Emissions — Under Direct (Brand) Control

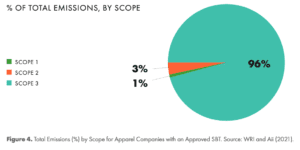

Emissions in Scope 1 and 2 only account for approximately 3% – 5% of an organisation’s total GHG emissions. Though the challenge to reduce these emissions is significant, there are a range of initiatives that are working to address them — primarily through the transition to renewable electricity, and other energy efficiency improvements in stores, offices and distribution centres (DCs).

One such example is The Fashion Pact, with signatories of the global coalition of companies in the fashion and textile industry having committed to achieving 50% provision of renewable electricity across their own operations by 2025,

and 100% by 2030.12 Their recent progress report (2020) revealed that signatories had achieved on average between 40% – 45% provision of renewable electricity across their own operations — just shy of the 2025 target with 5 years to go. However, this figure is partially due to some very large players achieving high rates of renewable electricity provision; with only approximately one third of the 70 companies achieving the goal. As with many climate related endeavours, the Fashion Pact suggests it is crucial that members collaborate, share learnings and work together to drive the adoption of renewables in their owned and operated facilities on an industry-wide level.13

For greater detail on Scope 1 and 2 emissions in the (branded) fashion industry — including information on setting reduction targets and methods to reduce emissions, the United Nations Framework Convention on Climate Change (UNFCCC) playbook provides extensive guidance for brands, retailers and manufacturers.14

Scope 3 — In Need of Attention

In many industries, Scope 3 often represents an organisation’s most significant greenhouse gas impact. The fashion industry is no different; on average, 96% of emissions stem from Scope 3 across those fashion brands with approved science based targets (SBTs).15 Within Scope 3 emissions, over 78% come from upstream emissions — purchased goods and services, with the remaining 22% from downstream emissions.16

Although attempts have been made to quantify the total emissions generated at an industry-level, different methodologies and analyses have led to different estimations of the total GHG emissions — ranging from 2% – 8% of global emissions.17/18/19 For the purpose of this report, the World Resources Institute (WRI) and the Apparel Impact Institute (Aii) estimates 1.05 gigatonnes of CO2eq (Gt CO2eq) generated by the industry — roughly 2% of total global emissions — will be used.20

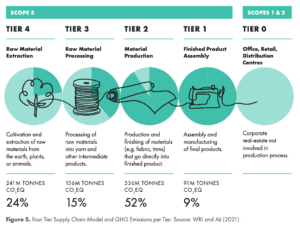

Another common and useful way of representing the apparel industry’s supply chain is in four Tiers. Tiers provide a more granular way of presenting Scope 3 emissions — dissecting the supply chain to its key steps and allowing for a greater understanding of emissions within Scope 3. This view can be reconciled to the 3 Scope model in Figure 5.

Figure 5 splits GHG emissions across each of the tiers of the supply chain. Clearly, the two biggest sources of emissions lie in Tier 4 — raw material extraction, and Tier 2 — material production. As such, many of the solutions to reduce emissions presented in this report focus on these tiers.

CONCLUSION

Identifying and understanding the sources, opportunities, and volume of financing for apparel industry decarbonisation is a crucial step in mapping a clear path of action for the future. This report segregates the financing opportunity by type of financier — illustrating the need for engagement for stakeholders across the finance industry. Sector-specific financing barriers are then cited, before presenting calls to action across each stakeholder within the industry to help to overcome these challenges and help achieve a net-zero future.