Unlocking the Trillion-Dollar Fashion Decarbonisation Opportunity

Barriers to Financing the Low-Carbon Transition of the Fashion Supply Chain

Barriers to Financing the Low-Carbon Transition of the Fashion Supply Chain

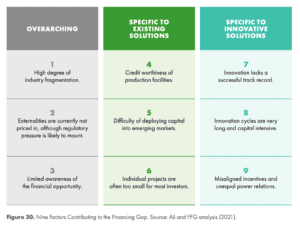

Based on interviews with manufacturers, investors, and key industry stakeholders, nine key factors that contribute to a lack of financing availability have been identified (see Figure 30).

The following pages provide additional details on these nine barriers.

OVERARCHING

High Degree of Industry Fragmentation

The fashion industry generally priotises price and has a very low level of vertical integration (i.e., brands rarely do their own manufacturing). As a result, a supply chain project is generally approved or denied funding based on the financial impact to the manufacturer that is undertaking the project. Often, increased costs in one step of the supply chain cannot be passed on to parties downstream (and ultimately to the consumer). Additionally, the fragmented and disconnected nature of the supply chain results in a lack of visibility on the operations of others, which makes it difficult for brands, as well as investors, to identify and act on opportunities within their own supply chains. This is a particularly challenging barrier for the fashion industry, where 96% of the total emissions are within the supply chain (see Figure 4).

Externalities Are Currently Not Priced in, Although Regulatory Pressure is Likely to Mount

Given the low prices of most commodities used in this industry (e.g., polyester – PET) and the industry’s focus on economics, many sustainable alternatives struggle to present attractive business cases due to their higher costs. Tighter regulation could enable the industry to take into account the significant environmental externalities of current production processes.

Limited Awareness of the Financial Opportunity

The demand for innovation and sustainability in the fashion industry has only recently accelerated, so private, public, and philanthropic investors have had limited exposure to the size and scale of the untapped opportunity in the coming industry transformation. Many of the investors and philanthropic funders questioned were not aware of how attractive the financial returns are for many of the solutions profiled in this report. Furthermore, sustainability professionals within the industry are often unaware of the potential financing mechanisms that are available.

SPECIFIC TO EXISTING SOLUTIONS

Credit Worthiness of Production Facilities

Long-term purchase agreements are rare in the fashion industry. As such, most manufacturers have limited visibility into order volumes beyond 12 months. Since the bank loans needed to support the projects in this report are

for multi-year periods, banks often seek assurances that volumes will be maintained during the life of the loan. This dynamic makes manufacturers appear less attractive for bank financing, preventing banks from investing in projects with a positive ROI and short payback period.

Difficulty of Deploying Capital Into Emerging Markets

There are many risks and obstacles to deploying capital into emerging markets. For one, many of the countries where apparel manufacturing facilities are located require government and local bank approval, making for a lengthy and complicated process. Furthermore, investors are hesitant to invest in markets that don’t have policies to support clean energy and where regulations can quickly change. Finally, investments into emerging markets present currency exchange rate risks, which can be offset by hedging, but causes financing costs to increase.

Individual Projects Are Often Too Small for Most Investors

Because investors have to spend time and resources underwriting each project, many individual projects,

such as adding solar panels to a single manufacturing facility, are too small for large investors to consider on

a one-off basis. There are currently not enough vehicles to aggregate opportunities together in order to make them more attractive to larger pools of capital.

SPECIFIC TO INNOVATIVE SOLUTIONS65

Innovation Lacks a Successful Track Record

The demand for industry innovation has emerged only recently, so investors have had limited exposure to the opportunity and successful exits are rare. Furthermore investors’ herd mentality results in some areas receiving significant funding, while other areas languish.

Innovation Cycles Are Very Long and Capital Intensive

Innovation cycles are very long and capital intensive, especially in new materials and recycling, where companies often take 10+ years to get to commercial revenue, which conflicts with the timelines of many venture capital investors.

Misaligned Incentives and Unequal Power Relations

Although brands have the greatest incentive and the most pressure to drive towards sustainability, efforts are limited, and the industry expects the upstream supply chain to account for the costs and risks, resulting in a misalignment of incentives for major innovation along the supply chain.